We've already discussed ways saving accounts help can make our money grow.

Today we discuss, in some depth, two more kinds of investments: stocks and bonds.

Stocks

Fact: Stocks are a way of growing wealth which can be much quicker than savings account or bonds.

However, the potential for more wealth in a shorter time usually means substantially greater risk.

Stocks

When an investor owns stock in a company, they become part owner of that company.

The buy small "units" of the company called shares.

The investor who owns stock in a company is called a shareholder.

Some companies distribute a portion of their profits to shareholder according to the number of shares they own. These payments are called dividends, and are paid yearly.

Stocks

Some companies don't pay dividends, which may influence the decision of the investor depending on their goals.

Investors who see owning stock as a longer-term investment might be more inclined to go with stock that pays dividends.

For investors who have shorter-term investment goals which involve choosing stocks which they believe will go up in price in order to sell them at a higher price a short time later will likely not be too worried about dividends.

Buying Stock

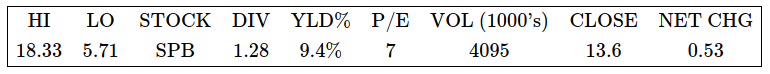

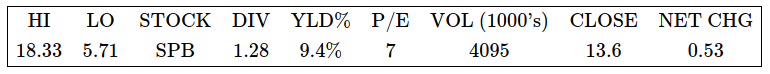

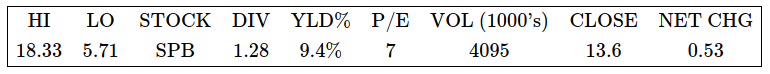

When a stock is listed, it contains key information which helps the investor understand the performance of that stock, and ultimately, whether or not they want to purchase shares.

Below is an example which contains the most common information in a stock listing.

The above is a stock listing for the S. P. Martini Beverage company whose symbol for trading is $\mbox{SPB}.$ Although the S. P. Martini Beverage Company is a fictitious company made up by Mr. Holt, it will illustrate the main ideas for our purposes.

We will now explain some of the meaning behind each of these numbers.

Example

Consider the stock listing below for the S. P. Martini Beverage Company.

(a) What were the highest and lowest values per share of $\mbox{SPB}$ in the last $52$ weeks?

The highest stock price in the last $52$ weeks was $\$18.33.$

The lowest stock price in the last $52$ weeks was $\$5.71.$

The lowest stock price in the last $52$ weeks was $\$5.71.$

(b) How much in dividends was paid per share last year?

$\$1.28$ was paid for each share of $\mbox{SPB}.$

(c) An investor who owned $700$ shares of $\mbox{SPB}$ stock made how much in dividends last year?

With $700$ shares, the investor received $700\cdot \$1.28=\$896.$

(d) How many shares of $\mbox{SPB}$ stock were traded yesterday?

The volume of shares in ($1000$'s) is reported as $4095.$

Therefore, $4095000$ shares were traded yesterday.

Therefore, $4095000$ shares were traded yesterday.

(e) How what was the closing price yesterday and the day before yesterday?

The closing price of $\mbox{SPB}$ stock was $\$13.60.$

The net change in the price since the day before yesterday's closing price was a gain of $\$0.53.$ Thus, the closing price the day before yesterday was $\$13.60-\$0.53=\$13.07.$

The net change in the price since the day before yesterday's closing price was a gain of $\$0.53.$ Thus, the closing price the day before yesterday was $\$13.60-\$0.53=\$13.07.$

Example

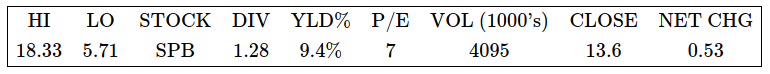

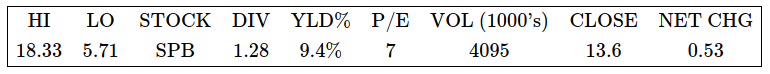

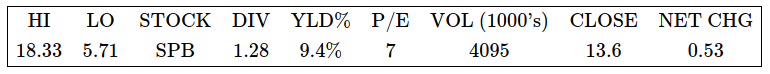

Consider the stock listing below for the S. P. Martini Beverage Company.

We now explain what numbers $\mbox{YLD%}$ and $\mbox{P/E}$ mean and what they can tell us about a stock.

Current Yield

Let's start with $\mbox{YLD%}.$

The symbol $\mbox{YLD%}$ is the current yield, and is the comparison between the dividends paid per share last year to yesterday's closing price: $$\mbox{YLD%}=\frac{\mbox{DIV}}{\mbox{CLOSE}}$$ Thus, for $\mbox{SPB}$ stock, the current yield is $$\mbox{YLD%}=\frac{\mbox{DIV}}{\mbox{CLOSE}}=\frac{1.28}{13.60}=0.094=9.4\%$$ rounded to the nearest tenth of a percent.

The P/E Ratio

We now explain what $\mbox{P/E}$ means.

$\mbox{P/E}$ is the "P/E Ratio." This number compares the current price (yesterday's closing price) to the total annual earnings of the company per share and is computed as $$\mbox{P/E}=\frac{\mbox{CLOSE}}{\mbox{Annual Earnings per Share}}.$$ This number can be interpreted as how many investment dollars it takes for the company to make one dollar of profit.

Thus, for the S. P. Martini Beverage Company, it took $\$7$ of investment to yield earnings of $\$1.$

Generally Speaking...

The P/E ratio is an indicator of how well the company makes money.

Therefore, to some investors this is an important metric that they interpret as the soundness of the investment; the lower the P/E ratio, the better the company is at making money.

Of course, like so many things in life, there is no magic number that will tell how to invest; there are plenty of things to consider.

An important consideration, for example, is the goals of the investor.

Another thing to keep in mind is that the P/E ratio can vary quite a bit if there's lots of variation in the closing price.

Annual Earnings per Share

Now, as you can plainly see, the annual earnings per share is not a number in the above stock listing, so we need to do a little magic to tease out this number (if it's something we want to know without having to review the company's annual reports). With a little algebra, $$\mbox{Annual Earnings per Share}=\frac{\mbox{CLOSE}}{\mbox{P/E}}.$$ So for the S. P. Martini Beverage Company, the annual earnings per share over the last $12$ months is $$\frac{\$13.60}{7}=\$1.94.$$

Buying and Selling Stock

Where there's money to be made, there's going to be lots of fingers in lots of pies, and trading stocks is no exception.

Stocks are traded on a stock exchange through a stockbroker who charges a commission on what you both buy AND sell. The commission is usually a fixed percentage of the buying or selling price of the volume of stock you wish to acquire or unload.

Nowadays, this could be a living, breathing human being who initiates the transaction for you, or an online broker with sales actually initiated by the investor.

Buying and Selling Stock

Example: Mr. Holt has sold $799$ shares of stock in The Continuum Cable Company through a broker who charges a $2.9\%$ commission.

If the price per share was $\$42.03$ when sold, how much did Mr. Holt receive from the sale?

$$

\begin{array}{lll}

\displaystyle \mbox{Value of Stock}&\displaystyle=799\cdot\$42.03=\$33581.97 &\mbox{}\\

\displaystyle \mbox{Commission}&\displaystyle=0.029\cdot \$33581.97=\$973.88 &\mbox{}\\

\end{array}

$$

Therefore, Mr. Holt will receive

$$

\mbox{Value of Stock}-\mbox{Commission}=\$33581.97-\$973.88=\$32608.09

$$

Example

Billy Bob has purchased $556$ shares of stock in The Continuum Cable Company through a broker who charges a $2\%$ commission.

If the price per share was $\$61.69$ what was Billy Bob's total cost to purchase the stock?

$$

\begin{array}{lll}

\displaystyle \mbox{Value of Stock}&\displaystyle=556\cdot\$61.69=\$34299.64 &\mbox{}\\

\displaystyle \mbox{Commission}&\displaystyle=0.02\cdot \$34299.64=\$685.99 &\mbox{}\\

\end{array}

$$

Therefore, Billy Bob will pay

$$

\mbox{Value of Stock}+\mbox{Commission}=\$34299.64+\$685.99=\$34985.63

$$

Example

At the beginning of the year, Sleazy P. Martini purchased $705$ shares of stock in The S.P. Martini Beverage Company through a broker who charges a $2.8\%$ commission at a price per share of $\$88.58.$

Later that year, Sleazy P. Martini sold the shares through a different broker who charges a $2.3\%$ commission at a price per share of $\$48.66.$

How much did Sleazy P. Martini make or lose on his investment?

At the time of purchasing the stock,

$$

\begin{array}{lll}

\displaystyle \mbox{Value of Stock}&\displaystyle=705\cdot\$88.58=\$62448.90 &\mbox{}\\

\displaystyle \mbox{Commission}&\displaystyle=0.028\cdot \$62448.90=\$1748.57 &\mbox{}\\

\end{array}

$$

Therefore, Sleazy P. paid

$$

\mbox{Value of Stock}+\mbox{Commission}=\$62448.90+\$1748.57=\$64197.47

$$

At the time of selling the stock,

$$

\begin{array}{lll}

\displaystyle \mbox{Value of Stock}&\displaystyle=705\cdot\$48.66=\$34305.30 &\mbox{}\\

\displaystyle \mbox{Commission}&\displaystyle=0.023\cdot \$34305.30=\$789.02 &\mbox{}\\

\end{array}

$$

Therefore, Sleazy P. received

$$

\mbox{Value of Stock}-\mbox{Commission}=\$34305.30-\$789.02=\$33516.28

$$

We see that

$$

\mbox{Profit}=\mbox{Selling Price}-\mbox{Purchase Price}=\$33516.28-\$64197.47=-\$30681.19

$$

Therefore, Sleazy P. Martini lost $\$30681.19$ on his investment.

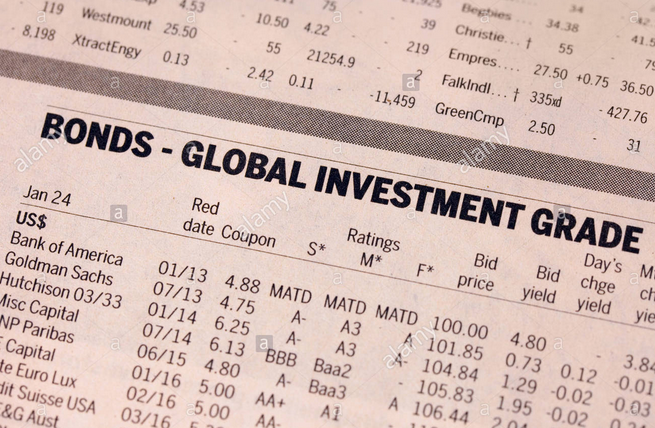

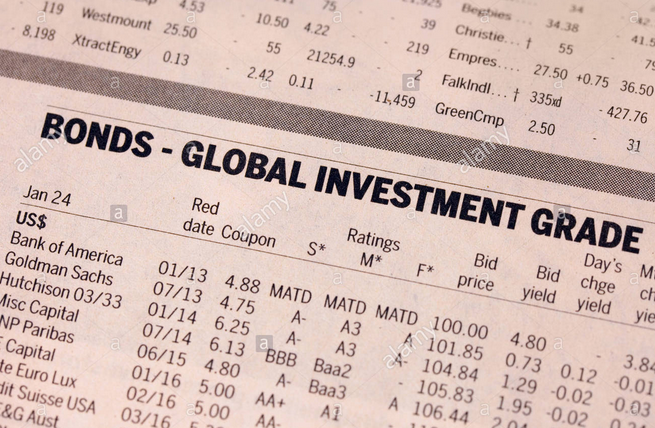

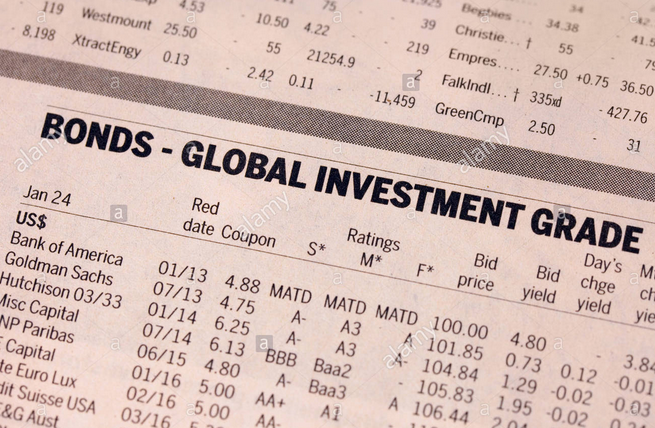

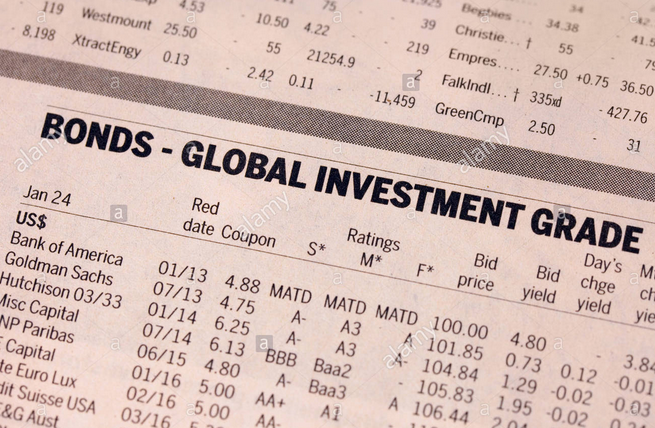

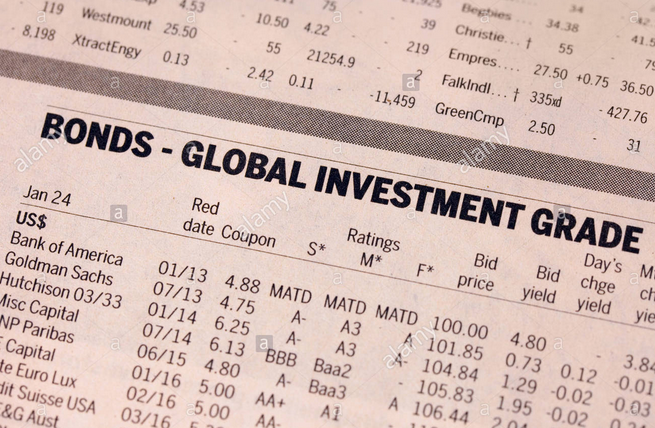

Bonds

In addition to stocks, another way that companies can raise capital is to issue bonds.

Bonds are essentially simple-interest loans you make to a company for specified period of time.

When the bond reaches maturity (the term of the loan is up), your money is returned at a specified rate of interest.

Bonds

The amount you pay for a bond is called its face value.

This is basically the principal amount of the loan.

Bonds

Bonds are generally considered a safer bet than stocks, but the potential for building wealth quickly is significantly less.

Although bonds are considered a safer investment, they are not a guaranteed investment. Companies do go belly up, in which case, the investor may never see their money again.

Bond Markets

Bonds are bought and sold in bond markets, and investors do so for various reasons. There is money to be made (and lost!) both buying and selling bonds.

Example: Sleazy P. bought a $\$1000,$ $5$-year bond that pays $3.5\%$ annual interest from the Continuum Cable Company. Two years later, he needs some fast cash now. So he unloads it for $\$800$ to an investor named Mr. Holt.

(a) How much interest will be paid by The Continuum Cable Company when the bond matures.

(b) How much money will Mr. Holt collect if he keeps the bond for the entire $3$ years before it matures.

(c) How much profit will Mr. Holt have made on his investment?

(d) What percent return will Mr. Holt see per year?

(a) The interest is simple interest with

$$

P=1000,\,\,\,r=0.035,\,\,\,t=5

$$

So,

$$

\begin{array}{lll}

\displaystyle I&\displaystyle=Prt &\mbox{}\\

\displaystyle &\displaystyle=1000\cdot 0.035 \cdot 5 &\mbox{}\\

\displaystyle &\displaystyle=175 &\mbox{}\\

\end{array}

$$

That is, at maturity, the bond pays $\$175$ in interest.

(b) Mr. Holt will collect face value of the bond ($\$1000$) plus the interest ($\$175$).

That is, Mr. Holt will receive $\$1175$ when the bond matures.

Note: We could have used the future value formula for simple interest. $$ \begin{array}{lll} \displaystyle A&\displaystyle=P(1+rt) &\mbox{}\\ \displaystyle &\displaystyle=1000(1+0.035\cdot 5) &\mbox{}\\ \displaystyle &\displaystyle=1175 &\mbox{}\\ \end{array} $$ (c) Mr. Holt spent $\$800$ and received $\$1175$ in return for a profit of $\$1175-\$800=\$375.$

(d) We can think of this as a $3$-year simple interest loan with an unknown annual interest rate and $$ I=375,\,\,\,P=800,\,\,\,r=\mbox{Unknown},\,\,\,t=3 $$ That is, $$ \begin{array}{lll} &\displaystyle I=Prt&\mbox{}\\ \implies &\displaystyle 375=800\cdot r \cdot 3&\mbox{}\\ \implies &\displaystyle 375=2400r&\mbox{}\\ \implies &\displaystyle \frac{375}{\color{magenta}{2400}}=\frac{2400r}{\color{magenta}{2400}}&\mbox{}\\ \implies &\displaystyle \frac{375}{2400}=r&\mbox{}\\ \implies &\displaystyle 0.15625&\mbox{}\\ \end{array} $$ So, Mr. Holt will see a yearly return rate of $15.625\%.$

(b) Mr. Holt will collect face value of the bond ($\$1000$) plus the interest ($\$175$).

That is, Mr. Holt will receive $\$1175$ when the bond matures.

Note: We could have used the future value formula for simple interest. $$ \begin{array}{lll} \displaystyle A&\displaystyle=P(1+rt) &\mbox{}\\ \displaystyle &\displaystyle=1000(1+0.035\cdot 5) &\mbox{}\\ \displaystyle &\displaystyle=1175 &\mbox{}\\ \end{array} $$ (c) Mr. Holt spent $\$800$ and received $\$1175$ in return for a profit of $\$1175-\$800=\$375.$

(d) We can think of this as a $3$-year simple interest loan with an unknown annual interest rate and $$ I=375,\,\,\,P=800,\,\,\,r=\mbox{Unknown},\,\,\,t=3 $$ That is, $$ \begin{array}{lll} &\displaystyle I=Prt&\mbox{}\\ \implies &\displaystyle 375=800\cdot r \cdot 3&\mbox{}\\ \implies &\displaystyle 375=2400r&\mbox{}\\ \implies &\displaystyle \frac{375}{\color{magenta}{2400}}=\frac{2400r}{\color{magenta}{2400}}&\mbox{}\\ \implies &\displaystyle \frac{375}{2400}=r&\mbox{}\\ \implies &\displaystyle 0.15625&\mbox{}\\ \end{array} $$ So, Mr. Holt will see a yearly return rate of $15.625\%.$

Bond Markets

Example: Suppose in the previous example, that after $2$ years, Mr. Holt got tired of waiting to get his money out of the bond he bought and sells it to Billy Bob for $\$1100.$

(a) How much does Mr. Holt receive in profit?

(b) How much does Billy Bob receive in profit when the bond matures?

(a) Mr. Holt receives $\$1100$ on an $\$800$ investment.

That is, Mr. Holt receives $\$300$ in profit.

(b) Billy Bob receives $\$1175$ on an $\$1100$ investment.

So, Billy Bob receives $\$75$ in profit.

That is, Mr. Holt receives $\$300$ in profit.

(b) Billy Bob receives $\$1175$ on an $\$1100$ investment.

So, Billy Bob receives $\$75$ in profit.

Bond Markets

With an example under our belt, we can talk a little bit more about the motivations of investors when it comes to bonds.

As mentioned earlier, bonds are bought and sold for various reasons. Desperation certainly could be among them.

Another more likely reason an investor might sell a bond at a loss is that the investor believes the bond will have less buying buying power in the future due to unexpectedly high inflation. If other investors are hip (which they likely are), then they may buy the bond for less than face value.

To the investor who sold the bond, even at a loss, the money they got back out of the bond can be used to invest in a booming stock market (hence the high inflation).

Bond Markets

On the other hand, when the bubble bursts, the economy recedes and the money supply shrinks or grows at a substantially slower rate.

Thus an investor is more likely to hold on to a bond in times of recession because the buying power of the bond upon maturity has increased. It is also the safer bet in less-certain times.

On the other hand, an investor might sell the bond at a premium over face value because of the expectation that the bond will have more buying power if the economy is slower. Moreover, if the maturity date is not far off, this might also influence the price of the bond since the return on the investment is also not far off.

Stocks, Bonds and General Investments

The above highlight the general trend when it comes to stocks and bonds.

When the economy is booming, trade in stock goes up and trade in bonds decreases.

When the economy is slow, trade in stock declines and trade in bonds increases.

Most investors hedge their bets by investing in both stocks and bonds to offset the effects of inflation and recession.

The mix of investments that an investor owns is called the investor's portfolio.

A diverse portfolio has a good mix of investments that offset losses when the economy is either growing or slowing.

Mutual Funds

Another investment option is to get in with a group of investors who buy in on a common collection of stocks and bonds. Money is paid into a mutual fund for the purpose of maintaining a particular portfolio.

Mutual funds are usually managed by people experienced in bond and stock markets. These managers control when and how much of an investment is bought or sold.

The usual tactic is to make lots of small investments over a wide range of companies. Again, maintaining a diverse portfolio is a way to offset losses when companies either perform poorly, or even fizzle.

However, not all mutual funds operate on the same level of risk. Some try to grow wealth more aggressively and are higher risk than others. Moreover, the reputations of some mutual funds are better than others. Most financial publications publish ratings on which mutual funds are solid, and which are shady.